By Lea Mira, HTN staff writer - 9.26.2024

Mews, the Amsterdam-based hospitality cloud company, has secured $100 million in financing from Vista Credit Partners, a subsidiary of Vista Equity Partners specializing in enterprise software and technology investments. This investment follows closely on the heels of Mews’ $110 million Series C funding round in March 2024, which valued the company at $1.2 billion. The new financing, structured as a credit facility, will be used to further accelerate Mews’ growth, particularly through strategic acquisitions.

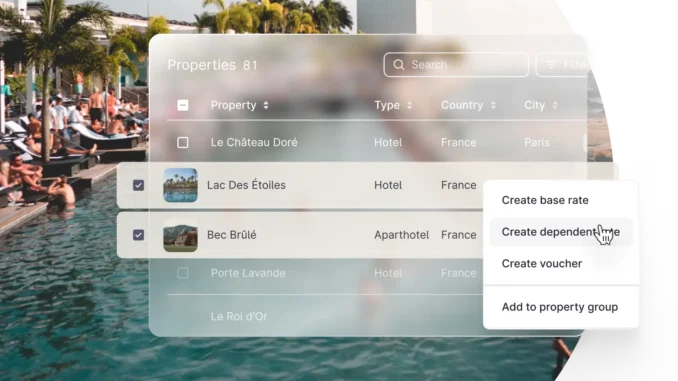

Founded in 2012 by Richard Valtr, Mews has emerged as a prominent player in the hospitality technology sector, offering a cloud-based property management system (PMS) designed to streamline operations and enhance the guest experience. The company’s platform provides a comprehensive suite of tools for hotels, including a booking engine, payments platform, point-of-sale system, check-in kiosks, and various integrations with other hospitality technology solutions.

According to the company, Mews currently serves over 5,500 hotels in 85 countries, with a notable presence among independent hotels and hotel groups like Strawberry, the Social Hub, and Airelles Collection. The company has experienced significant growth in recent years, particularly in North America, where its customer base has increased by 250% in the past year. This growth is driven by the increasing adoption of cloud-based solutions within the hospitality industry, as hotels seek to modernize their operations, improve efficiency, and enhance the guest experience.

According to the company, Mews currently serves over 5,500 hotels in 85 countries, with a notable presence among independent hotels and hotel groups like Strawberry, the Social Hub, and Airelles Collection. The company has experienced significant growth in recent years, particularly in North America, where its customer base has increased by 250% in the past year. This growth is driven by the increasing adoption of cloud-based solutions within the hospitality industry, as hotels seek to modernize their operations, improve efficiency, and enhance the guest experience.

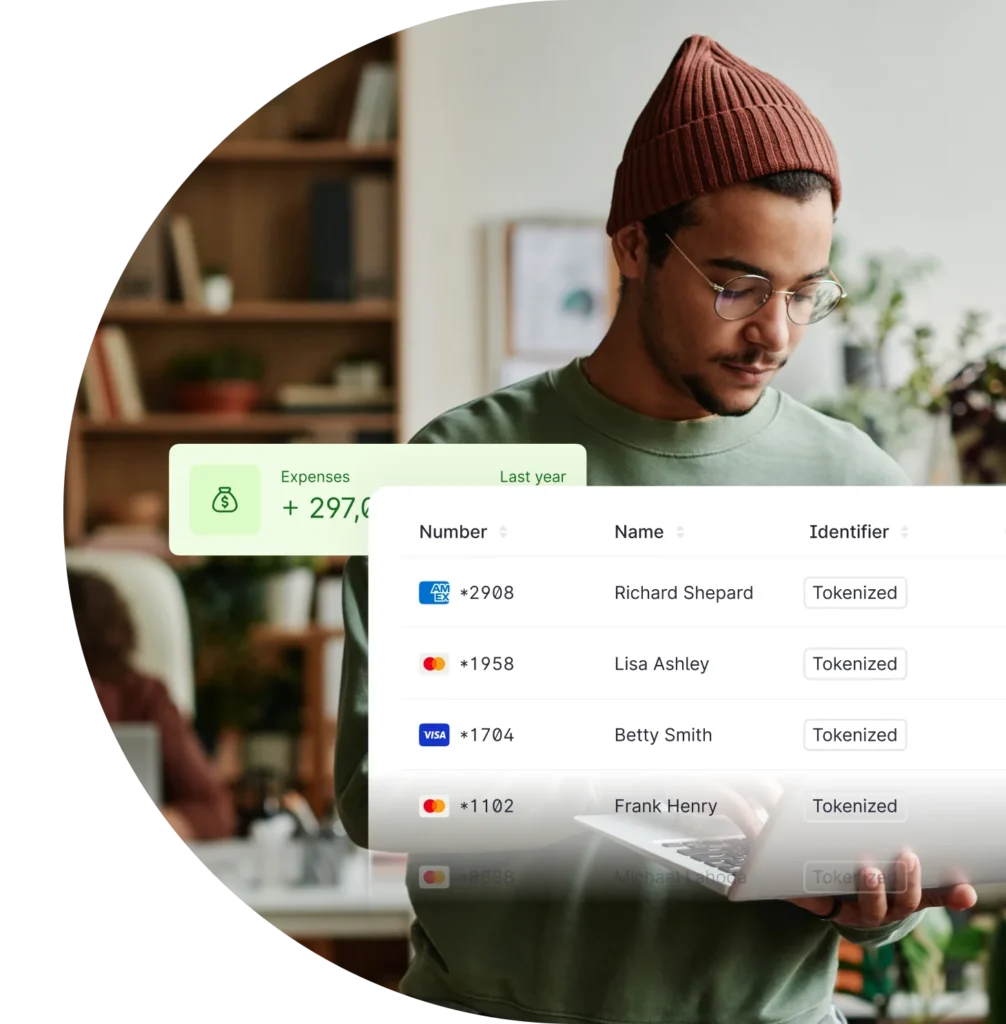

A key differentiator for Mews is its focus on automation and innovation. The company’s PMS leverages artificial intelligence (AI) to automate various tasks, such as managing reservations, optimizing pricing, and streamlining check-in processes. This allows hotel staff to focus more on providing personalized service and creating memorable guest experiences. Mews Payments, the company’s integrated payment processing solution, has also seen significant growth, with a 54% increase in volume since the beginning of the year, reaching over $8 billion year-to-date. This demonstrates the increasing comfort level hotels have with entrusting their financial transactions to cloud-based platforms.

The investment from Vista Credit Partners will primarily be used to fuel Mews’ ambitious mergers and acquisitions (M&A) strategy. Mews Ventures, the company’s dedicated M&A arm, has already acquired nine hospitality technology companies, demonstrating its commitment to consolidating the fragmented hotel tech landscape and building a comprehensive suite of solutions for its clients. This approach allows Mews to rapidly expand its product offerings and market reach, potentially giving it an edge over competitors who are developing solutions organically.

This focus on M&A aligns with a broader trend within the hospitality technology sector, where larger companies are acquiring smaller, specialized providers to expand their offerings and market reach. The increasing complexity of hotel operations, coupled with the growing demand for integrated solutions, is driving this consolidation. Hotels are increasingly seeking comprehensive platforms that can manage all aspects of their business, from reservations and guest communications to revenue management and staff scheduling.

While the investment from Vista Credit Partners provides Mews with significant financial resources to pursue its growth strategy, the company faces several challenges in the competitive hospitality technology market. Mews competes with established PMS providers, some of which have significant resources and a large installed base of customers. Additionally, the hospitality technology landscape is constantly evolving, requiring companies like Mews to invest heavily in research and development to stay ahead of the curve and meet the ever-changing needs of hoteliers.

While the investment from Vista Credit Partners provides Mews with significant financial resources to pursue its growth strategy, the company faces several challenges in the competitive hospitality technology market. Mews competes with established PMS providers, some of which have significant resources and a large installed base of customers. Additionally, the hospitality technology landscape is constantly evolving, requiring companies like Mews to invest heavily in research and development to stay ahead of the curve and meet the ever-changing needs of hoteliers.

Another challenge for Mews, and the industry as a whole, is addressing data security and privacy concerns. As hotels collect and store increasing amounts of sensitive guest data, ensuring data security and compliance with privacy regulations is paramount. Building trust with hoteliers and guests regarding the responsible handling of their data will be crucial for Mews’ continued success.

Furthermore, attracting and retaining top talent is an ongoing challenge for technology companies, particularly in the competitive hospitality sector. The demand for skilled technology professionals is high, and Mews will need to offer competitive compensation and benefits packages, as well as a stimulating work environment, to attract and retain the best talent.

Despite these challenges, Mews’ strong growth trajectory, innovative technology, and strategic focus on M&A position it as a key player in the evolving hospitality technology landscape. The company’s success will depend on its ability to effectively integrate acquired companies, continue to innovate its platform, and address the evolving needs of hoteliers in a rapidly changing market.

The investment from Vista Credit Partners, a seasoned investor in the enterprise software and technology sector, signals confidence in Mews’ ability to navigate these challenges and capitalize on the significant growth opportunities within the hospitality technology market. As the industry continues to embrace digital transformation, Mews is well-positioned to play a leading role in shaping the future of hotel operations and guest experiences.