By HTN Staff - 4.25.2023

Thynk, a global provider of advanced technology solutions for data-driven hotel sales and operations management, has announced details on its latest successful round of investment, resulting in $13 million received in Series A funding. Led by Singular, the $13 million equity investment also featured contributions from a New-York based fund managed by Itai Tsiddon, and Belgian investment firm CNP (Groupe Frère).

With Thynk continuing to experience rapid growth in meeting hotel industry operational needs, returning investors such as Fly Ventures also took part in the latest funding round. Thynk’s revenue performance has reportedly been a key factor in its successful performance, thanks to the adoption of its process automation, data-driven, and customer-centric verticalized platform by major hotel companies/groups, including Postillion (Netherlands), Rotana (UAE), Groupe Lucien Barrière (France), Design Hotels (Germany), and Mint House (USA).

According to company, the increased access to capital is expected to further fuel its R&D efforts as well as its ongoing global expansion, with teams and customers already present in European, American and Middle East hospitality markets. The stated goal is to empower the hospitality industry with a core solution that triggers business agility and performance, by streamlining sales, operations, and finance processes both on property and at an enterprise level. Thynk’s mission is to enable hoteliers to do more with less, to adapt faster to market changes and to focus on what leads to higher profit margins.

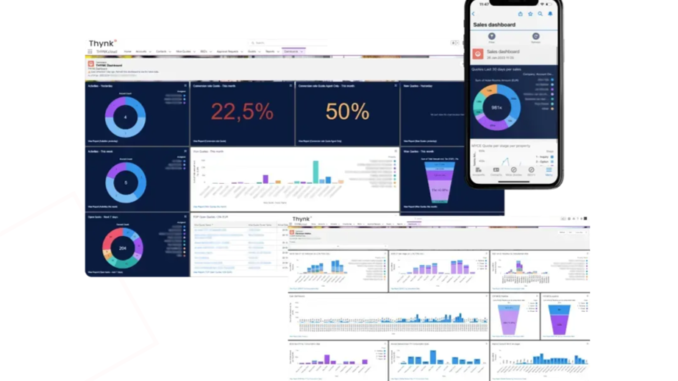

Thynk’s technology is built on top of Salesforce’s stack and acts as a turnkey information system for hotel groups. It collects, cleans, centralizes and unifies customer data to create unique IDs for each client. Thynk’s focus is on clients instead of rooms, like a CRM. After that, data can be used for several internal processes such as group booking, payment flows with deposits and pre-payments, and proposal production.

Thynk believes that property management systems will always be there to activate key cards, tell the hotel staff when a room needs to be cleaned, and perform other tasks, and Thynk’s technology won’t replace them. Thynk aims to empower more hotel brands, operators, and asset managers worldwide with tools proven to boost both efficiency and revenue.

With the latest source of funding, Thynk would seem to be well-positioned to accelerate its ambitious strategies, which include further enriching its data-driven and customer-centric revenue operating solution, solidifying its international presence, and empowering more hotel brands, operators, and asset managers worldwide with tools designed to boost both efficiency and revenue.