- By Oz Har Adir, Founder & CEO of Vio.com - 3.28.2025

When they were first introduced, metasearch channels quickly became an important part of travelers’ online shopping habits, as they were a way of getting an ordered overview of the endless shopping options available online. Growing rapidly in popularity during the 2010s, an industry report in 2017 showed that “nearly half of U.S. travelers used metasearch platforms for flight and hotel bookings;” that same year, another showed that “metasearch engines had become a dominant marketing channel, surpassing investments in traditional ads.”

That initial success did not last. An industry report showed that “metasearch’s share of travel traffic decreased from 22% in 2017 to 17% by 2020”, as it was no longer the most reliable or efficient way for travelers to find the best price on travel bookings – a trend that continues today.

But is the value proposition of metasearch dead or is it simply the original business model that failed?

To get to the bottom of this question, let’s look at the key commercial and consumer issues at play.

Ad-Based Revenue Model

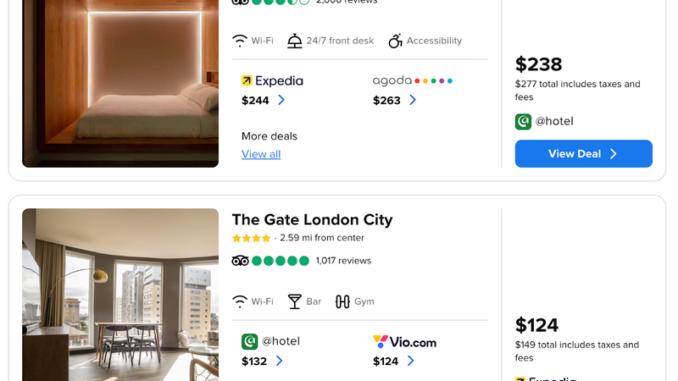

The advertising-based, cost-per-click (CPC) revenue model is fundamental for traditional metasearch sites. The sites earn revenue whenever a traveler clicks off the metasearch engine to visit an OTA or hotel site, regardless of whether the traveler books the stay. Because advertisers & hotels are ranked in the search results primarily based on their CPC bids (rather than on price), travelers are often not shown the best rates; rather, they are shown the rates that will earn the metasearch site more revenue.

This leads to higher prices being offered through the metasearch channels, helping sponsor higher bids, while customers click off the site quickly in search of better prices.

Another key problem that dilutes metasearch’s value proposition is the fact that Booking and Expedia are better able to navigate the CPC revenue model than smaller OTAs or direct booking sites. The result is that more than 3/4 of the revenue for many top metasearch channels comes from Booking and Expedia.

The value of metasearch engines is diminished because the OTAs’ public rates offered via metasearch are often higher than if the traveler searched directly, as a member of either OTAs loyalty program or on their apps, where cheaper rates are more likely to be offered.

Better prices from other sources are even harder to come by. An auction forcing high CPCs leads all hotels to raise the room rates offered through the metasearch channels – again, undercutting the value offered by the channels as they are not giving travelers access to the best rates.

As such, the business model of running multiple ads using ‘price comparison’ alone does not align well with the goal of the traveler – finding a great hotel with good value – nor the advertiser – to secure bookings with as low a cost of acquisition as possible – making traditional metasearch channels a lose/lose for both.

Simple Price Comparison Marketplaces

Booking a hotel is a subjective choice that requires research to get right. For travelers, price is one of the top criteria in their hotel selections, but it is not the only factor. Metasearch’s core functionality enables travelers to do a quick price comparison on the search results page and they must click through to the OTA or hotel site to get additional information about the room options, including:

- Room Images – Is it recently renovated? Does it look comfortable and clean? Is it well laid out for my needs?

- Payment Questions – Do I need to pay upfront, or can I pay later? Does the hotel support Apple Pay?

- Customer Support Questions – Does the hotel offer support in my language or currency?

- Detailed Reviews – How are the amenities? What have other travelers like me said about their stay?

In addition, the large metasearch channels do not find the cheapest prices and/or do not highlight them for travelers because they are largely offering ‘public’ rates, which are often limited by price parity agreements. Even when an OTA or hotel site offers a cheaper price than the rest, it must first meet the metasearch auction CPC price to be featured high enough in the search results where a customer would actually find and click on it.

In short, traditional metasearch offers travelers a ‘click and go’ experience that is not comprehensive enough to enable customers to complete their search or finalize a booking on the sites.

Lack of Customer Retention

Travelers’ online habits have evolved in the past years. This has led OTAs to invest in the growth of their apps and loyalty programs to convince users to begin their search on the OTA (rather than on metasearch). By offering better rates to members and customers using their apps, the OTAs have been able to retain users much more effectively.

Conversely, the traditional metasearch channels offer users no incentive to install their app or sign up to become members of their sites for two reasons:

- Their CPC revenue model financially disincentivizes them to do so because, instead of clicking on a paid ad, the sign-in process adds friction, leading to fewer revenue-generating ad clicks.

- If users do sign in, the auction dynamics changes, and they may see better prices. Again, this is counterproductive to traditional metasearch channels’ revenue model as higher bids would be less likely to win the click, leading to fewer clicks and lower revenue per click.

As such, the metasearch channels’ cost of acquisition must be repaid within the session (hence the CPC revenue model), while an OTA can repay its cost of acquisition across the lifetime of the user.

Now, we get to the most important part… with all these innate problems, how can metasearch sites still provide value for both travelers and hotels?

Here’s the truth: traditional metasearch channels are dying, but that doesn’t mean that the utility of an effective price comparison tool is no longer valuable, both to travelers and hotels.

That being said, to be successful today, metasearch channels must expand beyond simple price comparison to offer sophisticated OTA functionality, which addresses the diverse needs of today’s travelers and enhances the overall booking experience.

A Customer-Centric Approach

Finding the best hotel at the best value is the end goal of travelers using metasearch sites; as such, to be successful these hybrid booking channels must adopt the same as their product goal to create a win-win business model.

The best way to do that is to change from an ad-based CPC model – which doesn’t benefit travelers or hotels – and adopt a robust customer-centric strategy using a cost-per-action revenue model based on booking conversions. Given that lower prices convert more often, they are more likely to show higher in the search results, incentivizing hotels to offer better deals.

Integrated OTA Functionality

Like a traditional OTA, this hybrid metasearch model must include comprehensive information about the various accommodation options to empower users in their decision-making process. A traveler can take their time, browsing through room images, understanding each offer’s cancellation terms, filtering reviews, etc. They can stay on-site to book through the internal OTA or go elsewhere.

At the same time, innovative OTA functionality – such as price freezes enabling travelers to take their time deciding on the best hotel, price alerts, membership incentives, incentives to download the app, etc. – are valuable tools to maximize customer retention and the customer value.

Transparency & Personalization

When the transparency that is fundamental to the metasearch model is combined with OTA functionality, conversion and retention rates increase because travelers know they are getting a good deal and appreciate that they don’t need to visit multiple sites to compare prices. We now see OTAs adopting the same strategies, turning their search results or hotel pages into transparent offerings. When they can offer the best price, they rank on top; when they can’t, they tell the customer where they should go to get a better deal, rather than accepting a low conversion outcome and unsatisfied customers.

To become successful, metasearch sites must evolve to a traveler-focused, CPA-based revenue model, which includes both price comparison and OTA functionality to maximize price and product transparency, increasing their value proposition for all audiences. By making these changes, metasearch sites can once again become a trusted booking channel for travelers and firmly re-establish themselves as a sustainable and profitable marketplace for hotels.

So, the bottom line is clear: metasearch isn’t dead; it just needs to be reimagined.

By Oz Har Adir, Founder & CEO of Vio.com, a hotel booking site trusted by 100 million users each year to find better value on every stay, with savings of up to 45%. The company discovers exclusive accommodation deals and compares prices across top travel sites, so travelers can book the best room with confidence. The company’s exceptional customer support team is available 24/7, which is reflected in their rating on Trustpilot and rapid growth. In addition to their B2C offering, Vio supports their B2B partners with their comprehensive white label solution, which enables flight-only booking channels to offer accommodation through their sites as well. To date, many industry leaders – including Skyscanner, Super, and Wego – have used the white label solution to leverage Vio’s exclusive prices, accommodation inventory and technical capabilities to offer their users better rates and a superior integrated booking experience, while maximizing their business successes and profits.

By Oz Har Adir, Founder & CEO of Vio.com, a hotel booking site trusted by 100 million users each year to find better value on every stay, with savings of up to 45%. The company discovers exclusive accommodation deals and compares prices across top travel sites, so travelers can book the best room with confidence. The company’s exceptional customer support team is available 24/7, which is reflected in their rating on Trustpilot and rapid growth. In addition to their B2C offering, Vio supports their B2B partners with their comprehensive white label solution, which enables flight-only booking channels to offer accommodation through their sites as well. To date, many industry leaders – including Skyscanner, Super, and Wego – have used the white label solution to leverage Vio’s exclusive prices, accommodation inventory and technical capabilities to offer their users better rates and a superior integrated booking experience, while maximizing their business successes and profits.

Are you an industry thought leader with a point of view on hotel technology that you would like to share with our readers? If so, we invite you to review our editorial guidelines and submit your article for publishing consideration.