By Lea Mira, HTN staff writer - 6.13.2025

Canary Technologies has raised $80 million in Series D funding to accelerate its global expansion and deepen its leadership position in AI-powered hotel guest technology. The round was led by Brighton Park Capital with continued support from existing investors Insight Partners, F-Prime Capital, Thayer Ventures, Y-Combinator, and Commerce Ventures. The new capital brings Canary’s valuation to roughly $600 million and comes just one year after its $50 million Series C raise.

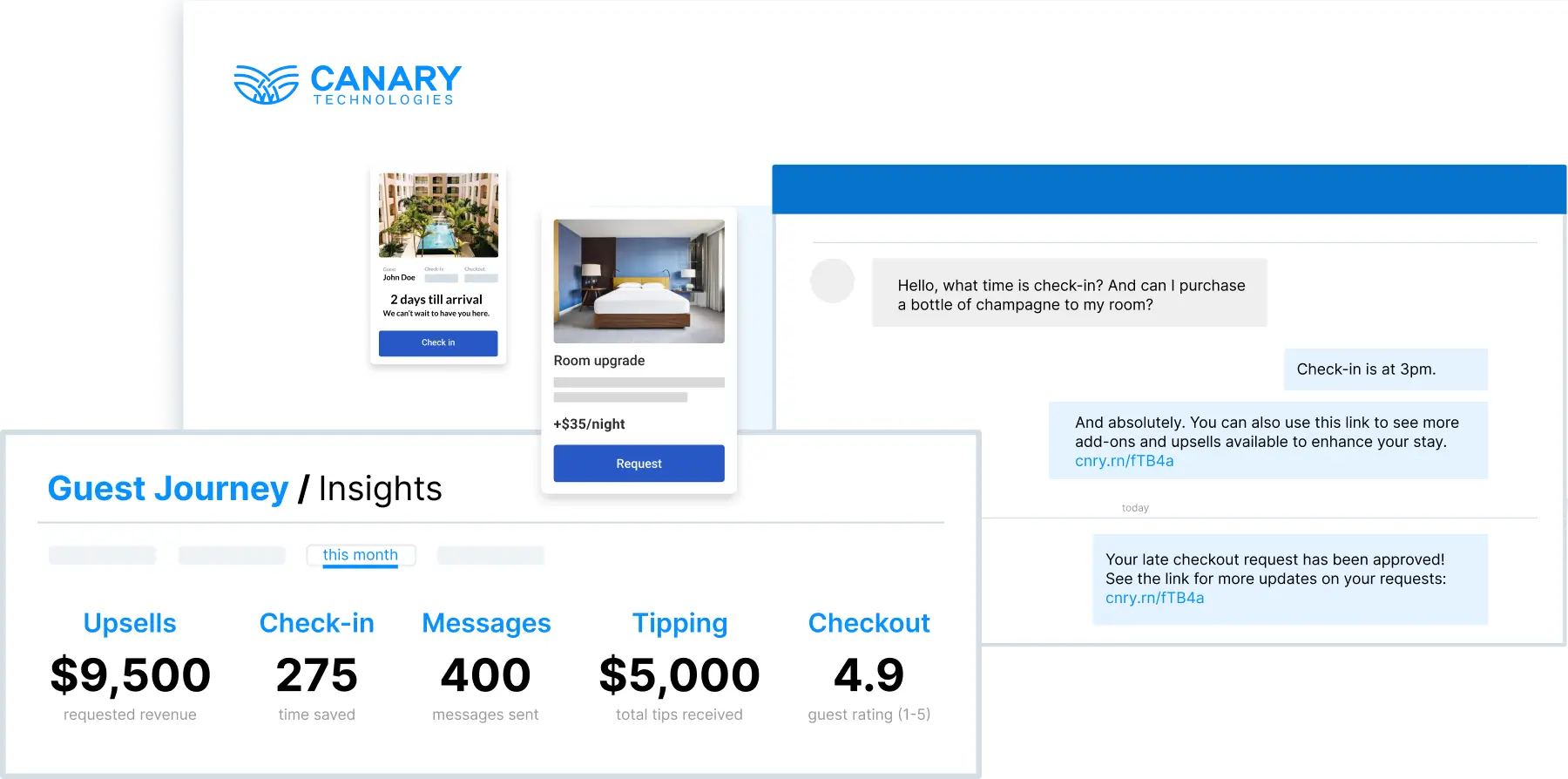

Founded in 2018, Canary has grown to support more than 20,000 properties across over 100 countries. Its product suite includes tools for contactless check-in, guest messaging, digital tipping, mobile checkout, and, more recently, AI-based voice and chat capabilities. The company’s client roster includes a wide range of properties, from independent boutiques to global brands like Marriott, Wyndham, Best Western, and Aimbridge Hospitality.

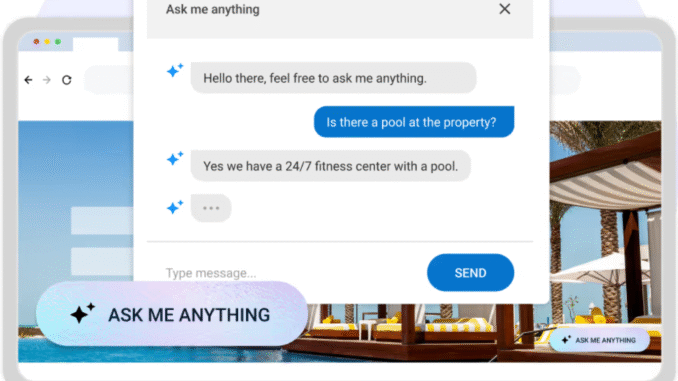

The new investment underscores rising demand for guest-facing AI solutions in the hospitality sector. Hotels are increasingly looking to reduce labor burdens and improve service delivery through automation. Canary’s latest AI offerings—AI Voice and AI Webchat—are designed to manage guest interactions in real time, providing responses to frequently asked questions, routing requests, and facilitating seamless communication across departments.

According to CEO Harman Singh Narula, the company’s goal is to help hotels “run smarter” and deliver more personalized service at scale. Co-founder and President SJ Sawhney noted that product development is grounded in hoteliers’ operational workflows, which Canary integrates into its design and feature sets. Brighton Park Capital described Canary’s growth trajectory as “unprecedented” within the hospitality space and expressed confidence in the company’s ability to maintain category leadership globally.

Canary’s success comes amid a broader investment surge into hospitality tech, particularly around AI, data analytics, and operational automation. In April, Mews raised $110 million in a Series D round led by Kinnevik and Goldman Sachs Asset Management, pushing its valuation past $1.2 billion. Mews, a cloud-based property management system (PMS) provider, has focused heavily on API-driven extensibility and integrations that allow hotels to build modular technology ecosystems.

Similarly, Life House, which offers a vertically integrated hotel management and software platform, secured $60 million in Series C funding earlier this year. The round, led by Inovia Capital with participation from Derive Ventures and Kayak’s parent company Booking Holdings, is aimed at expanding Life House’s reach among independent hotels that want to automate revenue management, dynamic pricing, and operations without giving up branding autonomy.

In the AI space specifically, Asksuite—a Brazil-based company focused on AI-powered hotel communication—raised a $10 million Series A round in March. While smaller in scale, its funding reflects growing interest in AI tools that can support multilingual guest engagement and reduce call center load.

Several other solution providers have attracted significant capital to fuel expansion and meet the rising demand for smarter, more integrated hotel operations. ROH, a specialized sales and payments automation platform for the hospitality industry, secured $9.2 million in a round led by Highgate Technology Ventures. DIAMO, which focuses on AI-powered revenue optimization for independent hotels, raised $4 million to enhance its global footprint. Meanwhile, SuiteOp, targeting communication and operations for small to mid-sized lodging providers, attracted $3 million in seed funding. On the back-office side, Inn-Flow recently landed a $45 million investment to accelerate innovation within its unified accounting, labor, and operations platform.

The common thread among these investments is the industry-wide shift toward digital infrastructure that enables more agile operations, particularly as staffing shortages and rising customer expectations persist. Hoteliers are no longer investing solely in front desk tools or basic guest messaging platforms; they’re seeking systems that connect the guest journey from pre-booking to checkout, while reducing friction and manual intervention along the way.

Canary’s positioning in this evolving landscape is notable for its focus on guest-facing use cases, rather than the broader property management or revenue optimization space. Its strength lies in its ability to integrate directly with PMS platforms, payment systems, and in-room technologies, offering hotels a relatively turnkey solution for digitizing the guest journey. The company has also gained credibility by emphasizing security and enterprise-grade scalability—two critical considerations for large hotel groups.

Despite a competitive field that includes both established players and newer startups, Canary appears to have carved out a distinct niche focused on improving guest engagement through intelligent automation. Its ability to win enterprise contracts and maintain rapid growth suggests strong execution and a deep understanding of hotel operational needs.

Looking ahead, the hospitality sector is likely to see continued consolidation among tech providers, as operators seek more integrated and scalable platforms. Whether Canary maintains its momentum will depend on its ability to deliver measurable ROI through AI-driven enhancements while continuing to support a broad and growing portfolio of hotel partners.

The new funding gives Canary additional runway to build on that strategy. If current trends hold, it won’t be the last major funding announcement the hotel tech world sees this year.