11.14.2024

Nick Falcone, founder and Managing Principal of Rentyl Resorts, is a recognized innovator in Florida’s tourism and hospitality industry. His entrepreneurial journey began with NDM Hospitality Services, where he successfully launched and scaled the BurgerFi franchise. Now, with Rentyl Resorts, Falcone is applying his business acumen and technology-driven approach to transform the vacation rental market.

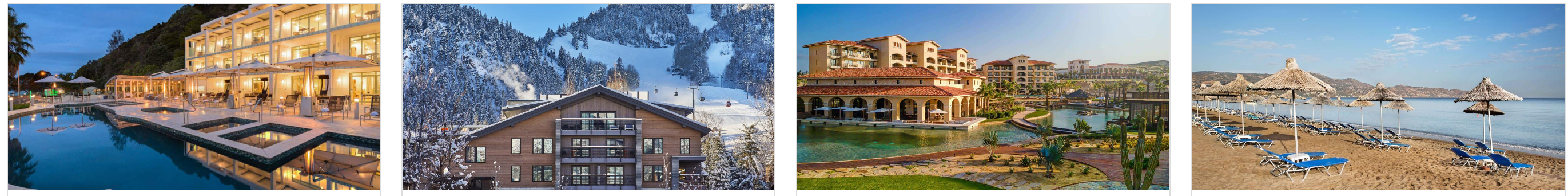

Rentyl Resorts blends the comforts of a home with the amenities and services of a resort, offering a unique and consistent brand experience for guests. The company has experienced significant growth since its inception in 2015, expanding its portfolio to over 100 properties and establishing partnerships with major brands like Margaritaville and Embassy Suites.

In this Spotlight Interview, Falcone discusses Rentyl Resorts’ growth strategy, its technology innovations, and his vision for the future of the vacation rental industry. He delves into the evolving dynamics of the market, the increasing importance of technology and brand recognition, and the challenges and opportunities of scaling a business in the competitive hospitality sector.

Since its inception in 2015, Rentyl Resorts has grown its vacation rental portfolio to more than 100 properties. What has driven this impressive growth?

We’ve executed our business development plan well. We’ve strengthened our business development team, our outreach strategy, and our way of connecting with potential partners. Now, we are building trust with developers and educating them on how our product is unique in the vacation rental market.

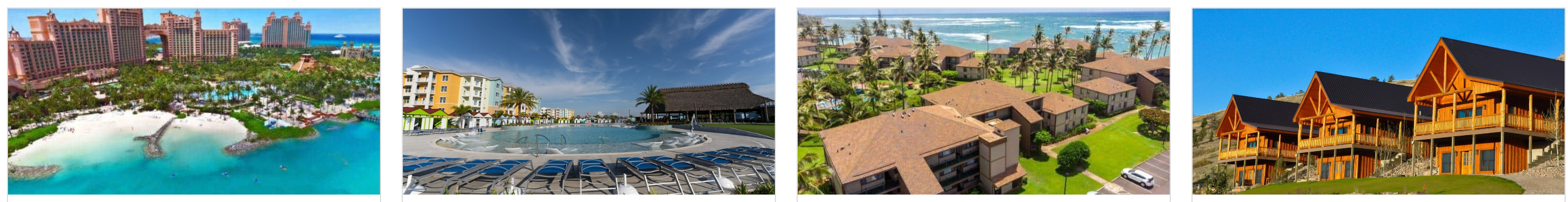

We began our journey by launching our first branded residential resort in the world, Encore Resort at Reunion. As we grew, other brands joined our portfolio, including Margaritaville Resort Orlando, The Bear’s Den Resort Orlando, Spectrum Resort Orlando, Embassy Suites Sunset Walk, Atlantis Paradise Island, and Beachwalk.

The other component is the change in the economic landscape. The interest rate and lending environments are such now that a hotel brand will find it difficult to obtain financing unless it has a residential component. In many states, a developer can apply the deposits collected from homebuyers as equity in the capital stack. That financial advantage has evolved to the point that having a residential component as part of a hotel product or as a standalone residential resort has become the dominant strategy within the hospitality space.

Third would be our professionalism and commercialization within the vacation home space. In the past, large financial institutions didn’t have commercial opportunities to invest in full resorts within the vacation rental market as all of the product was desperate inventory managed by small rental management companies. With a proven business concept, a powerful platform, many profitable locations, and respected brand partners, large institutional investors now see the hotel-plus-residential and standalone resort residential resort models as a much more feasible investment opportunity.

Rentyl Resorts initially focused on Florida, specifically the Orlando area. What prompted you to expand the company worldwide? What challenges did you have as the company grew?

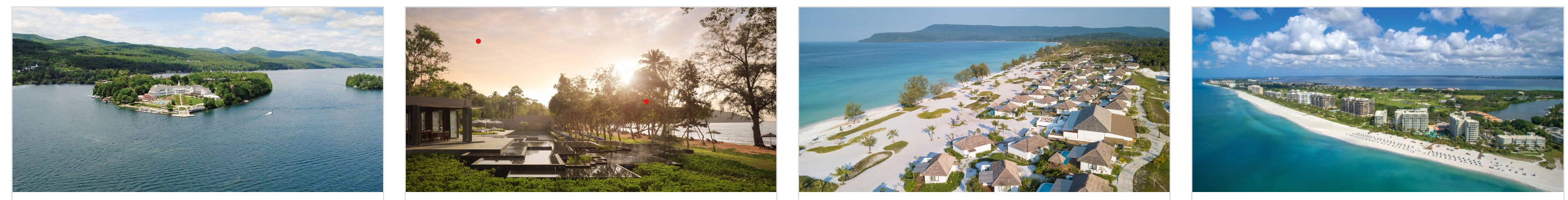

We embarked on an expansion when we felt confident that what we were doing in our region was working. Our development partners had sold more than $2 billion in vacation home sales, while our company complimented these sales with our successful business model and being there to guide buyers on how the rental program works. We saw early on that our model was outperforming the vacation rental market in our region, and as that stayed consistent throughout our first few years in business we felt we were ready to take our business concept to the world and other developers.

We have components of our business model that is operationally based so it was important to avoid the challenges of spread out operations by being clustered in specific regions where we can organically build our operations infrastructure. However, our other components—branding, strategic development, services, and other menu offerings—are easily expanded around the world. We also encountered new laws, regulations, and hiring practices as we entered different states and countries. Experience taught us to be prepared for them.

How have Rentyl’s technology innovations and platform differentiated it from competitors in the vacation rental market?

We have developed a number of proprietary technologies that simply work better than what else is on the market. One is our master data-management system; it connects the dots between the multiple systems that hospitality companies use to obtain data on customers, products and other information. One example of our system capabilities is that it can link customer information from one of our website forms with logs and recordings from the same customer’s conversation with a call center agent and an in-person inquiry onsite. Our master data system puts all the information in one place where it is accessible to everyone who comes into contact with that individual afterward. For example, a person with a dietary preference doesn’t need to tell every dining room server about it. That information will be in the restaurant’s database, even though it may have been collected from a different source. Not only can the team better serve that customer, but we can better execute our remarketing capability.

While big hotel brands have invested in systems like ours, from my experience, it’s something that you rarely see in practice. And almost no one else on the vacation home side has this capability.

Our other differentiator is our loyalty program, which we custom-designed to encourage consumers to interact more with our brand through day-to-day transactions rather than the typical two trips a year. As travel program members spend, they build points toward free or discounted travel. In Orlando, we awarded points not just for travel but for purchases at our retail center. We are geographically expanding the rewards program as we continue to grow. In the future, the program will provide opportunities for purchasing with points aspirational items such as a home, which strengthens our database and our bond with the user.

What role do you see artificial intelligence (AI) and machine learning playing in the future of the vacation rental industry? And how is Rentyl Resorts preparing for these advancements?

AI is going to take many different paths. In the short term, we are already seeing how machine learning and AI can make an impact. Here’s an example: In the past, in our marketing department, a graphic designer created something from the ground up. AI can create a base design template in two seconds, and the designer can build off that. AI is also being utilized to speed up other processes.

However, I’m a big believer that AI is not far enough along for true, human-like communication. Some travelers are focused on dates and locations, while others are focused on experiences. We tried using chatbots in 2023 and found that the technology fell short of giving people what they wanted. So, my vision of AI in our booking engine is not one in which the customer types into static fields such as dates and locations and then the platform pumps out a lot of results. Instead, I would like the customer to be able to tell the booking engine the key factors they are looking for. The AI would offer curated options based on the conversation.

We also have learned that AI does not understand the tone people are using when asking for those things and how to respond appropriately. One day, AI will be more capable.

Let’s look ahead. How do you envision the future of the vacation rental industry and the role Rentyl Resorts will play in that?

I’m obviously biased in saying we are at the forefront of where the market is going. As the vacation rental model progresses, the Airbnb booking platform and the Vacasa property management model will become less desirable. As brands and professional management companies come in with better technology and broader distribution, it will be impossible for homeowners to operate on their own.

Second, the consumer will start to demand a more controlled environment with branded experiences that include amenities and services like the ones we offer.

Third, brands like Airbnb spend half a billion dollars or more each quarter on marketing on desperate inventory versus bulk inventory at resorts. It’s a no-brainer that a commercial-branded product with bulk inventory at each resort property is much more financially feasible for driving revenue at a efficient cost. Revenue-management components will increase the financial feasibility with a controlled, branded environment and the elimination of safety concerns.

Last, commercial investors and developers now have a product they can get behind financially. As more and more residential resort properties are developed, it will be rare, maybe never, that you will see a traditional hotel built without a residential component. When that component becomes almost a prerequisite to development and operations, big corporations will begin to dominate the market. Homeowners will realize that their best investment is not buying or building a home and renting it but buying it through brand-name hotels and resorts and brand platforms. We’ll see how it progresses.