By Nadav Schnall, CEO of ProSentry - 7.11.2025

A major water leak in a hotel can create a host of problems for the operator to deal with. Angry guests, refund requests, canceled bookings, and costly repairs are among the immediate consequences. But a potentially bigger and costlier issue may not arise until your insurance renewal. Once a property has experienced a substantial water damage incident, insurers may reassess its risk profile, which can lead to higher premiums from the renewal date onwards.

However, effective proactive monitoring can help to mitigate these risks, and in some instances can even help to reduce forecasted insurance renewal increases for hotel properties with a history of water leaks.

The True Cost of Water Damage in Hotels

Water incidents can quickly escalate from minor maintenance issues into serious operational problems if they are not detected and acted upon within good time. A major leak has the potential to displace guests, force room closures, trigger refund requests, and lead to negative reviews.

But water damage in hotels isn’t only a guest-facing issue. A preeminent casino hotel in Atlantic City experienced this firsthand. In 2022, unusually cold temperatures froze and fractured a pipe, causing a major leak in a mechanical area. The incident resulted in over $5 million in insurance payouts. While no guest rooms were affected, the insured losses suffered by the hotel were substantial.

In the above example, following the water leak incident, the property’s insurance broker projected premium increases totaling close to $5 million over the following five years. And not only did the hotel operator face higher renewal premiums, it also found it more challenging to attract the multiple carriers that were required in order to provide enough capacity to cover the total insured value of the hotel of nearly $1 billion.

How Prevention Technology Transforms Risk Management

The Atlantic City property’s response shows how hotels can turn water damage incidents from an ongoing cost into a manageable, controllable risk. Their team took a systematic approach: first identifying high-risk areas like mechanical rooms, pool systems, and locations previously affected by freeze damage, then deploying targeted sensor networks with automatic response capabilities.

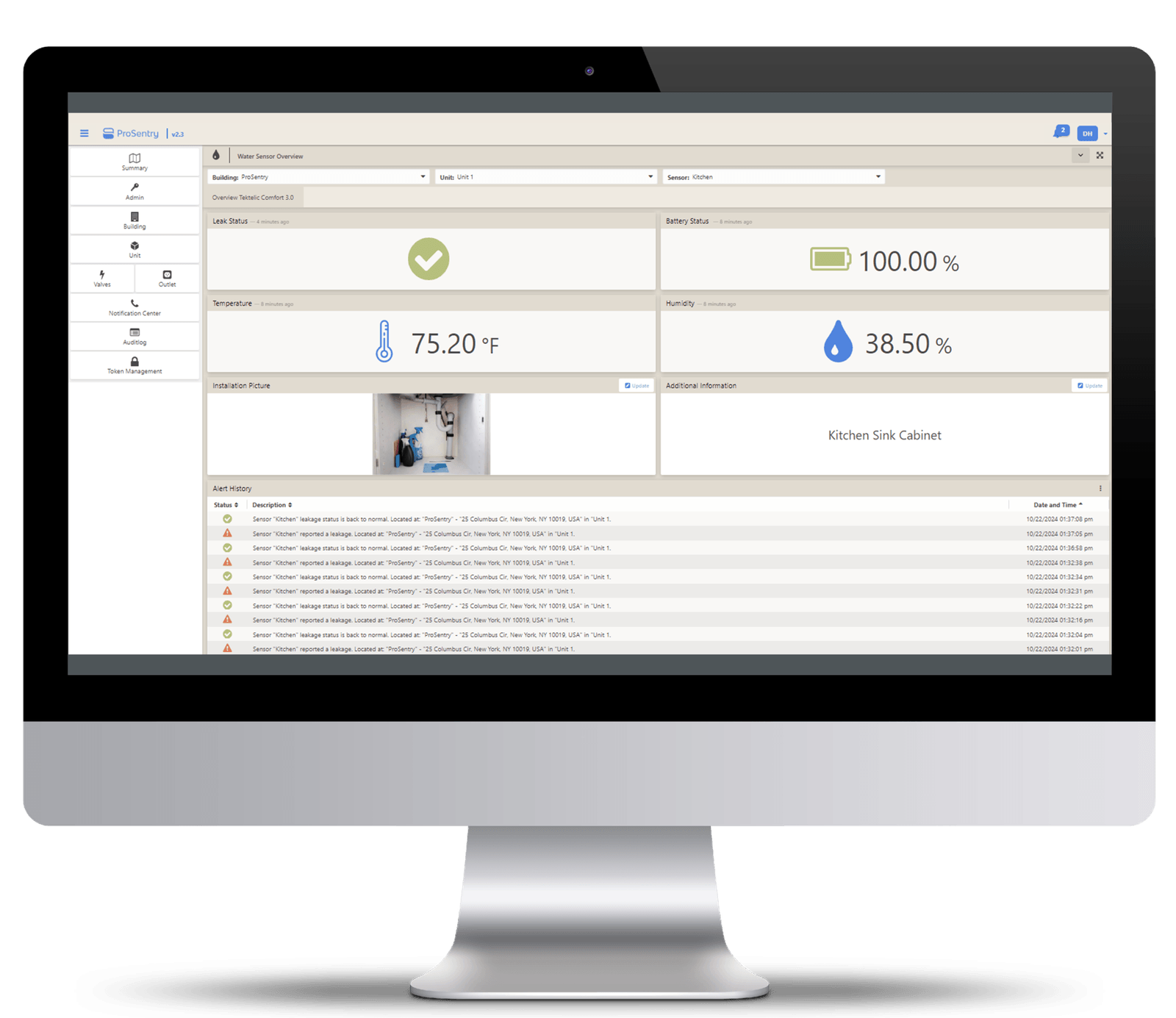

Wireless sensors were installed around pool filters, pumps, and mechanical equipment, with additional temperature monitors to prevent freeze-related failures and automatic shut-off valves for catastrophic leaks. The system also included sensors to detect oil leaks and prevent environmental hazards.

These wireless devices, roughly the size of a popsicle stick, with a 10-year battery life and enterprise-grade reliability, continuously monitor the property. If water is detected, the system sends alerts in under a minute through multiple channels – text, email, app notifications, and, most importantly, live operator calls to hotel staff.

These wireless devices, roughly the size of a popsicle stick, with a 10-year battery life and enterprise-grade reliability, continuously monitor the property. If water is detected, the system sends alerts in under a minute through multiple channels – text, email, app notifications, and, most importantly, live operator calls to hotel staff.

This real-time response capability now enables the hotel to catch and contain incidents quickly, thereby minimizing potential damage and reducing the risk of costly claims. As a result, the property’s investment in monitoring technology helped them to reduce their forecasted insurance premium renewal increase.

How to Leverage Insurance Benefits and Operational Efficiency

Hotel properties with a history of water leaks may find their insurance premiums increasing at renewal to reflect the increased risk this represents to carriers, like in the example above. It’s in this type of scenario that a comprehensive leak detection system could possibly be leveraged to not only prevent future leaks, but also to help reduce insurance premium increases.

Some insurance brokers and specialist risk management consultants are working in conjunction with smart-monitoring companies to develop risk mitigation strategies which can then be presented to carriers in the marketplace, in order to secure more competitive terms for a hotel’s property insurance renewal.

While outcomes will always depend on the property’s loss history and overall risk profile, proactive measures like these can strengthen a hotel’s position when negotiating coverage terms, particularly for properties with a history of water leak claims.

When it comes to implementation, focus first on high-risk, high-impact areas such as guest bathrooms, mechanical rooms, HVAC systems, pool areas, and any locations with a history of water damage. The wireless design of modern sensor systems typically allows for quick installation with minimal disruption to guest areas.

It’s also essential to establish clear response protocols so staff know exactly how to respond when alerts are triggered, ensuring issues are addressed quickly and consistently.

Operationally, this technology shifts maintenance from reactive to proactive. Rather than relying on guest complaints or periodic inspections, maintenance teams receive real-time alerts and can intervene immediately.

The Bottom Line

Water damage prevention is becoming an important operational consideration for hotel operators looking to reduce risk exposure and improve operational resilience. The implementation process is straightforward: identify high-risk areas, deploy monitoring technology and integrate alerts with existing operations.

For hotel operators, where day-to-day disruptions can quickly escalate into costly problems, proactive water damage prevention provides both short-term protection and long-term operational stability.

Nadav Schnall is CEO of smart building monitoring company ProSentry, which provides comprehensive wireless sensor networks that monitor for water leaks, gas leaks, and other building risks, delivering real-time alerts and live operator calls to prevent issues from escalating into major claims. The company’s platform has caught over 3,600 leaks with zero false alarms, helping buildings secure insurance discounts and coverage that might otherwise be unavailable.

Nadav Schnall is CEO of smart building monitoring company ProSentry, which provides comprehensive wireless sensor networks that monitor for water leaks, gas leaks, and other building risks, delivering real-time alerts and live operator calls to prevent issues from escalating into major claims. The company’s platform has caught over 3,600 leaks with zero false alarms, helping buildings secure insurance discounts and coverage that might otherwise be unavailable.

Are you an industry thought leader with a point of view on hotel technology that you would like to share with our readers? If so, we invite you to review our editorial guidelines and submit your article for publishing consideration.