By HTN Staff - 11.18.2021

OTA Insight, which has emerged in recent years as a leader in cloud-based hotel business intelligence, has raised $80 million in funding from Spectrum Equity, a growth equity firm focused on internet-enabled software and transformational data companies.

According to a press statement, the investment will support the company in furthering its mission to enable smarter commercial decisions and outputs across the industry as it expands its global footprint. The London-based company, which was founded in 2012, had previously raised only $20 million, so this round represents a big win for the company and a major vote of confidence from existing investors, which includes Eight Roads, F-Prime Capital and Highgate Technology Ventures.

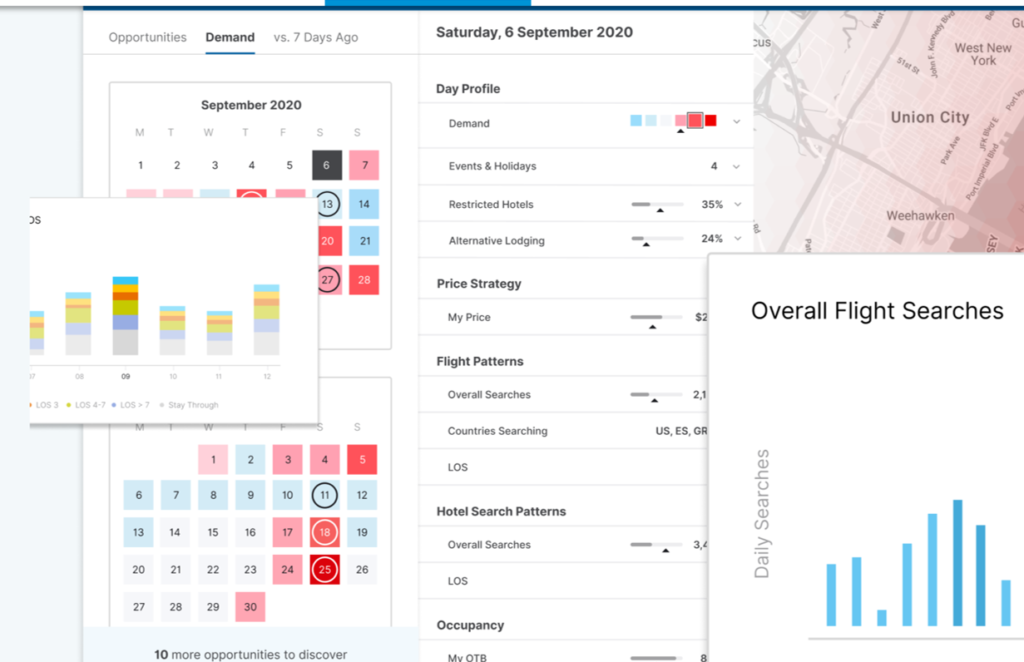

OTA Insight delivers data and analytics to optimize decision making for. Its innovations include a rate intelligence solution for global hotel chains, local brands, management companies and ownership groups dubbed Rate Insight. The tool includes a rate-type comparison feature that essentially removes the need for report generation and analysis and allows hoteliers to easily understand and evaluate competitors’ discounting strategies at the click of a button. Hoteliers can analyze different rate variations, including length-of-stay, public vs member rates, mobile versus desktop rates, meal plans, best flex vs lowest rates, number of guests and much more, and extract detailed competitor discounting plans via a simple side-by-side comparison dashboard.

Last year, the company launched Market Insight, an advanced AI-powered technology that taps into billions of forward looking data-points from multiple top of funnel data sources ranging from hotel web searches, online reviews, flight data, events, holidays, and alternative lodging inventory data to deliver location-specific, segmented demand insights. Hoteliers and revenue managers are able to quickly anticipate future market demand, uncover early revenue opportunities with live alerts and easily evaluate their properties’ competitiveness against their “dynamic” compset.

Over 55,000 hotel properties in 185 countries reportedly use OTA Insight’s platform, which, in addition Rate Insight and Revenue Insight includes Parity Insight, to make complex pricing decisions and understand rapidly evolving market, channel and competitor dynamics in real time. OTA Insight integrates with industry tools including hotel property management systems, leading RMS solutions and data benchmarking providers. Customers include major hotel brands such as Radisson, Holiday Inn, and Crowne Plaza.

“Prior to the pandemic, the hospitality industry had been open to gradually adopting new technology. Our business experienced significant growth through 2020 despite the industry headwinds, but 2021 has been a breakthrough year for us as the recovery accelerated the pace of technology adoption. We anticipate unprecedented opportunities and growth as the recovery continues,” said OTA Insight’s CEO, Sean Fitzpatrick, in a press statement. “For global chains and independent hotels alike, we have made the use of data simple and intuitive to drive better commercial decisions and provide a real competitive advantage.”

The investment by Spectrum Equity will reportedly fuel OTA Insight’s growth in key areas of product innovation, engineering, sales, and global expansion. “We are very excited about the response from our customers to our latest products and innovations,” said Gino Engels, co-founder and CCO. “With this investment we will accelerate our expansion across all regions in 2022 but particularly in the Americas, where we have seen an incredible recovery.”

“We are so grateful to the OTA Insight team, our customers and our partners who have continued to trust and support us through the global crisis,” said Matthias Geeroms, co-founder and CFO. “We strive to be a business with a great culture and strong core values that put our team members and customers first. This investment marks the next milestone on our journey as we continue to build a world-class company to serve the changing needs of the industry.”