By Larry and Adam Mogelonsky - 10.19.2023

The fourth quarter brings the all-too-important annual tradition of budget planning for next year, and yet 2024 ‘s specific challenges have given the more heavily integrated hotel technologies a unique time to shine.

As we review the numbers thus far from 2023, operational and labor costs continue to edge up in lockstep with guest service expectations, and yet some of the latest projections show travel demand as normalizing at or slightly above current levels. This can lead to a scenario of stagnant growth and diminished net contributions (in both real and nominal values), coming right at a time when macroeconomic forces like the pursuit of sustainable operations are compelling hotels to devote extensive capital towards a property improvement plan (PIP).

It follows that a top priority should be tightening cost controls to optimize profitability ahead of rolling out any new ventures, where traditionally many areas ripe for savings aren’t readily apparent due to the complexity and interconnectedness of hotel operations across multiple properties. So, it’s important that on-property and above-property management look at how new data connections can help to reveal hidden opportunities to improve margins and give more breathing room for any necessary capex that ownership will have to commit to within the next few business cycles.

To get a clearer picture of the specific use cases that have emerged from these new data connections as well as how they affect a P&L, we sought out Steven Moore and Michele Schnieder, respectively the CEO and VP of Product Operations at Actabl, who gave us as a preview of what the company would share at The Lodging Conference.

With some enterprises running nearly a hundred different systems at any given time depending on their portfolio specifics and service offerings, hotels really need to focus on consolidating their tech stacks in order to find relationships amidst the sheer noise of data as well as prevent dashboard fatigue. Hence, the purpose of our lengthy discussion with Moore and Schnieder was to run through ways that hotels can home in on cost savings by using an entire product suite in lieu of single-purpose middleware.

Incremental Wins in Housekeeping and Maintenance

One in-vogue strategy that the two of us have celebrated in our writing and actively helped clients to get more proverbial ‘juice from the squeeze’ – in this sense, more gross revenue with direct flowthrough to net-operating income (NOI) – is to deploy a variety of tactics to promote a channel shift from third parties to direct, greatly lowering customer acquisition costs on an apples-to-apples basis.

But while decreasing the cost per acquisition to then increase gross profit per booking is a noble objective, hotels may still be hamstrung by a combination of out-of-service (OOS) and out-of-order (OOO) rooms, throttling occupancies, when demand exists, by as much as 5%.

(For clarity on the difference between these two acronyms, OOS refers to rooms that are only temporarily blocked as they require a bit more cleaning or a minor fix, versus OOO denotes rooms that are taken out of inventory for extended periods due to serious repairs, deep cleaning or renovations. Distinguishing between these two states is important as it affects RevPAR calculations.)

By itself, this may seem like a small number that’s conventionally chalked up to simply the cost of doing business. But shifting your perspective to think in terms of incremental improvements allows management to deliver successively better profits within a limited time frame. In this case, supposing even just a 2% uptick in occupancy for a hypothetical 200-room property with an annual ADR of $250 would result in a $365,000 bump to yearly gross revenues – not a small sum, especially when combined with other plans to simultaneously tighten opex. How is this done, though?

By itself, this may seem like a small number that’s conventionally chalked up to simply the cost of doing business. But shifting your perspective to think in terms of incremental improvements allows management to deliver successively better profits within a limited time frame. In this case, supposing even just a 2% uptick in occupancy for a hypothetical 200-room property with an annual ADR of $250 would result in a $365,000 bump to yearly gross revenues – not a small sum, especially when combined with other plans to simultaneously tighten opex. How is this done, though?

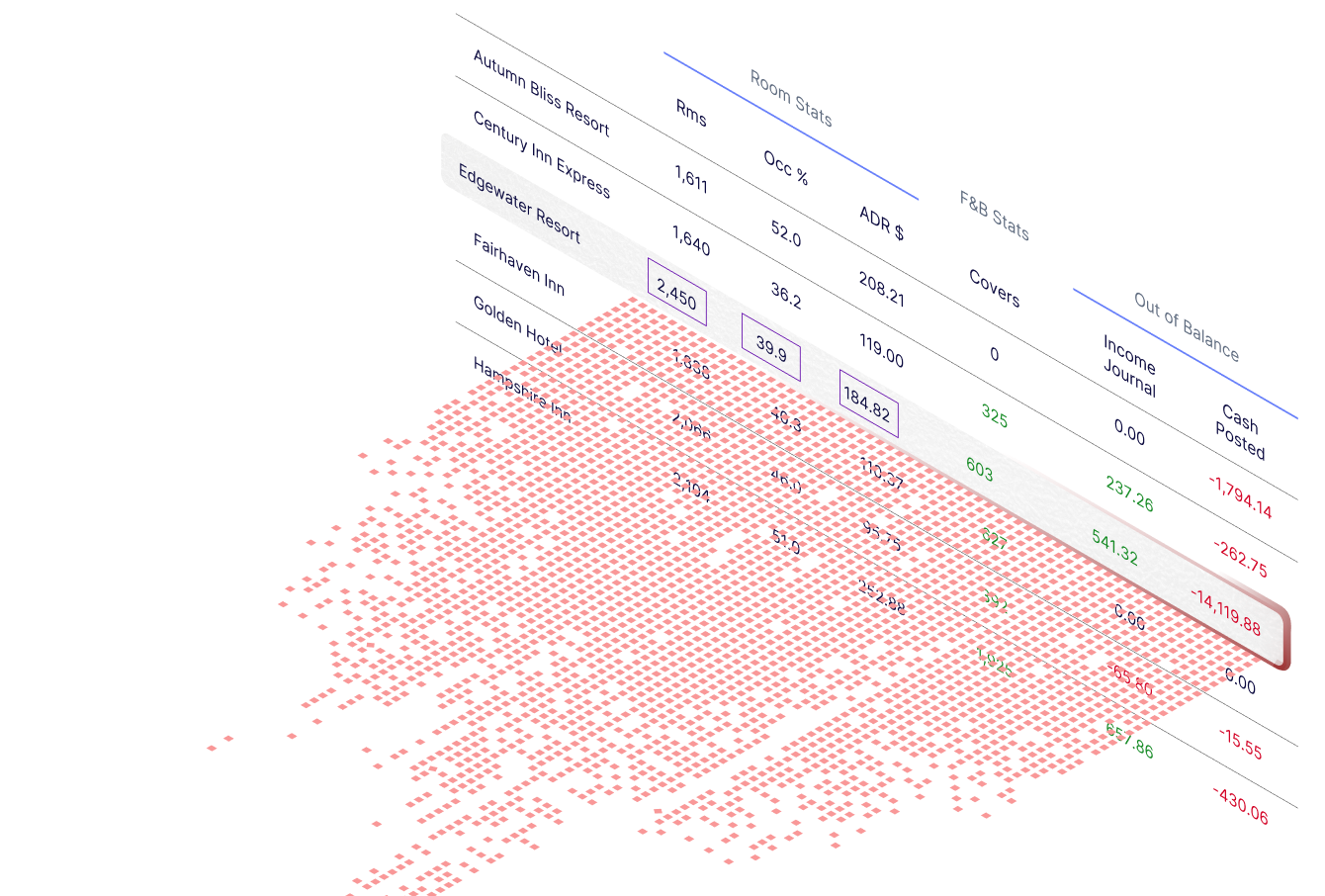

“With a robust integration between ALICE, our hotel operations platform, Transcendent, our maintenance software, and ProfitSword, our business intelligence platform, we are now able to tabulate OOO rooms by reason code across an entire portfolio,” explained Schnieder during our conversation as we were going through these scenarios where tech can help boost NOI.

“This lets corporate find commonalities amongst all the repairs taking place to then derive strategies for more speedily addressing the top issues. It’s a bit like the 80/20 rule here; 80% of your losses are caused by 20% of your problems. Integrated hotel software lets you pinpoint that 20% so that properties can limit room downtime by, for instance, adjusting the plans for regrouting bathrooms or by reorienting deep cleaning schedules.”

More specific to deep cleans that may increase OOO rooms as well as curtailing OOS rooms that can’t be resold during a high-room-turnover time of week, Schnieder gave us a sneak peek of ALICE’s Housekeeping Optimizer which allows executive housekeepers or supervisors to more efficiently build boards, schedule room attendants and monitor performance.

This hits on a new service trend that the two of us have witnessed: guests want their rooms ready irrespective of the time they arrive, and disappointment here can lead to lower guest satisfaction scores (GSS) or increased costs due to error recovery measures. At first, we attributed this to post-pandemic angst that would eventually subside, but now we’re more of the belief that you can’t change the way the river is flowing, so we’re now advising hotels to look for ways to meet a 24/7 check-in expectation.

Also driving the push for just-in-time housekeeping in this regard is the growth of last-minute reservations, where any number of OOS rooms that hinder occupancy maximization can mean revenue left on the table. Taken together, the solution is a nimble, tech-forward cleaning operation that can balance the available team with the now wildly varying demands of modern guests.

The Benefits of Better Internal Benchmarking

With the pursuit of sustainability in hospitality, one key objective at the above-property level is to ensure there are enough funds set aside for a PIP that may involve replacing equipment with more energy efficient models in addition to exterior modifications. Such a renovation can cost millions and take years to plan out.

In the interim, however, companies can sharpen energy and water usage by benchmarking data on a regional basis, a brand-wide basis or across an entire portfolio of different flags.

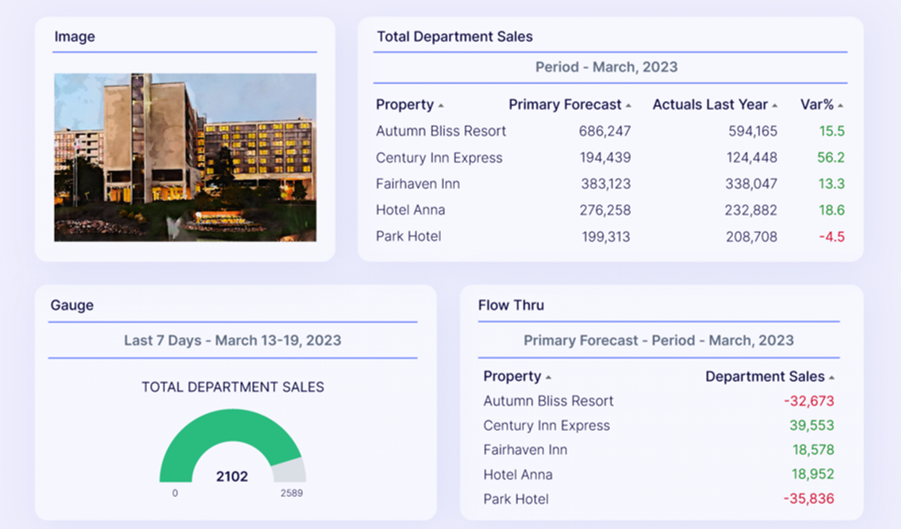

Specifically, Moore showed us a visualization dashboard within ProfitSword for a portfolio where the insights engine effectively filtered the multitudes of siloed data to show which properties had higher utilization over normalized expectations. In one particular case, the software recognized a leak at a resort with a waterpark before the onsite engineers had a chance to do their routine inspections.

Specifically, Moore showed us a visualization dashboard within ProfitSword for a portfolio where the insights engine effectively filtered the multitudes of siloed data to show which properties had higher utilization over normalized expectations. In one particular case, the software recognized a leak at a resort with a waterpark before the onsite engineers had a chance to do their routine inspections.

Next, by merging in then benchmarking data from Transcendent across multiple properties that included OOO rooms, maintenance logs and the lifespans of all capital assets, above-property management was able to identify the most cost-effective suppliers in terms of lowest breakdown rates and longest life cycles. This then reduced the total time spent by onsite engineering teams on work orders and also gave the enterprise more buying power when negotiating new parts orders.

Thirdly, besides directly tightening preventive maintenance for fewer nights lost to OOO rooms and incremental occupancy gains, bringing in GSS as well as team scores and then equating all this with ops data has meant that companies can more holistically optimize for which specific on-property enhancements are actively contributing in a meaningful way to the ‘experience’. To color this word, a boost to GSS can help to support ADR growth strategies, while for the employee the result is better talent retention.

Technological Succession Planning

The other term that the two of us have used in the past to ascribe to dashboard fatigue is ‘zombie platforms’ wherein a hotelier has so many different screens already that when a new piece is added it’s immediately forgotten.

Hence, while the biggest advantage of strongly interfaced technologies pertains to the hidden insights that can be revealed to grow the topline or the bottom line, a close second is the value from having all the data amalgamated and then filtered so that executives can more readily act on what’s explicitly relevant to them.

One more benefit to all this is what occurs when migrating to the cloud – an all-but-natural action when upgrading to today’s best-in-breed hospitality solutions. Notably, such a migration preserves the integrity of the data even as managers, management teams or owners change hands on a particular asset, thereby preventing the turbulence of having to reconstruct it all from disparate, offline Excel files.

We’ve all been through these types of situations where there’s a management turnaround, an acquisition or a key team leader leaves and data is lost, or you have to politely ask the departing executive for information on their hard drive. The term to note for this pain point that supportive, all-in-one, cloud-based platforms can solve is “technological succession.”

Just as every hotel has policies in place to support the growth of individual team members’ career paths via succession planning, our discussion with Moore and Schnieder confirmed yet another way that multifaceted technology solution providers like Actabl have become instrumental to the smooth, continuous operations of hotels with all the oddities and nuances that come along when selling any time-based inventory.

To close, if the game is incrementally improving NOI so that there’s a better margin of safety for ownership, then perhaps the clearest way to go about this is to centralize data from numerous sources, both on-property and enterprise-level, in order to reveal those previously unknown culprits that should be tackled first. No matter what 2024 brings, tightening controls in terms of quick, successive wins will help you weather any storm as well as give you the most buffer to facilitate further growth.

Together, Adam and Larry Mogelonsky represent one of the world’s most published writing teams in hospitality, with over a decade’s worth of material online. As the partners of Hotel Mogel Consulting Limited, a Toronto-based consulting practice, Larry focuses on asset management, sales and operations while Adam specializes in hotel technology and marketing. Their experience encompasses properties around the world, both branded and independent, and ranging from luxury and boutique to select-service. Their work includes seven books: “In Vino Veritas: A Guide for Hoteliers and Restaurateurs to Sell More Wine” (2022), “More Hotel Mogel” (2020), “The Hotel Mogel” (2018), “The Llama is Inn” (2017), “Hotel Llama” (2015), “Llamas Rule” (2013) and “Are You an Ostrich or a Llama?” (2012). You can reach Larry at larry@hotelmogel.com or Adam at adam@hotelmogel.com to discuss hotel business challenges or to book speaking engagements.

Are you an industry thought leader with a point of view on hotel technology that you would like to share with our readers? If so, we invite you to review our editorial guidelines and submit your article for publishing consideration.